Short-term rentals offer furnished living spaces for temporary stays, serving as hotel alternatives. Platforms like Airbnb and VRBO connect hosts with travelers, enabling flexible bookings. These rentals provide attractive financial opportunities for investors, combining high demand with potential tax benefits and scalable income streams.

1.1 What Are Short-Term Rentals?

Short-term rentals are furnished properties available for temporary stays, typically ranging from a few days to several months. They serve as flexible alternatives to hotels, often managed through platforms like Airbnb and VRBO, connecting hosts with travelers seeking unique, well-equipped, and conveniently located accommodations.

1.2 How Do Platforms Like Airbnb and VRBO Work?

Platforms like Airbnb and VRBO act as intermediaries, connecting property owners with travelers. Owners list their properties, set rates, and establish house rules. Travelers search, select, and book accommodations online. Payments are processed through the platform, which also provides tools for communication, reviews, and dispute resolution to ensure smooth transactions.

1.3 Benefits of Short-Term Rentals for Investors

Short-term rentals offer investors high demand, flexible pricing, and strong cash flow potential. They provide tax benefits, such as deducting mortgage interest and maintenance costs. This model also allows for scalability, enabling investors to expand their portfolios and adapt to market trends for maximum profitability.

Market Analysis and Research

Market analysis is crucial for investors to identify profitable locations, understand demand patterns, and assess competition. It helps make informed decisions and maximize returns.

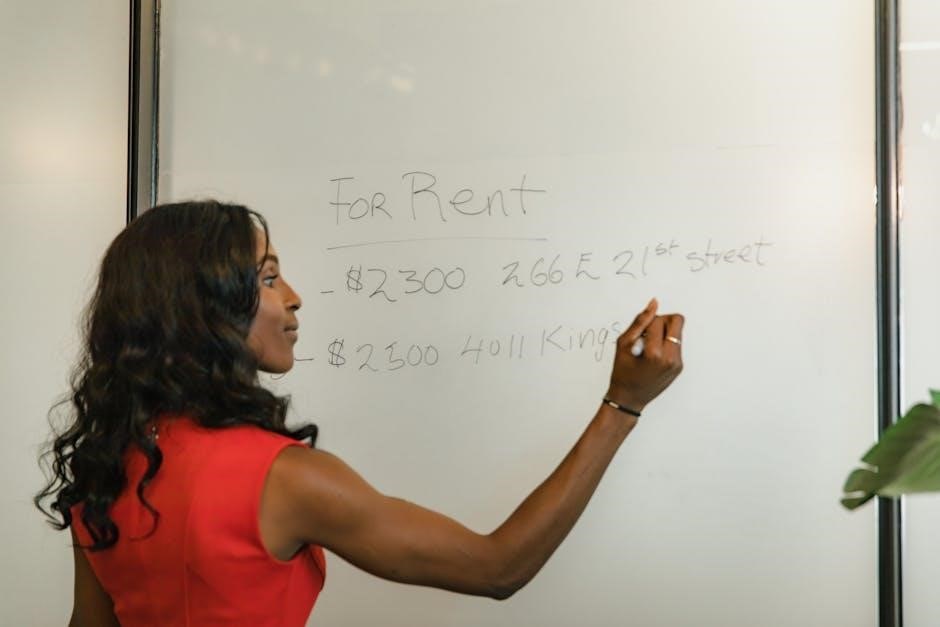

2.1 Identifying Profitable Locations for Short-Term Rentals

Profitable locations for short-term rentals often have high demand due to tourism, events, or business activity. Areas with growing economies, popular attractions, and limited supply attract travelers, ensuring steady bookings and higher returns for investors.

2.2 Understanding Seasonal Demand and Pricing Trends

Seasonal demand significantly impacts short-term rental profitability, with peaks during holidays, events, or summer/winter breaks. Pricing trends vary by location, requiring dynamic adjustments to maximize revenue. Analyzing historical data helps anticipate fluctuations, enabling investors to set competitive rates and capitalize on high-demand periods effectively.

2.3 Conducting a Competitive Analysis

Conducting a competitive analysis involves identifying top-performing listings in your area, comparing pricing, amenities, and occupancy rates. This helps uncover gaps in the market, allowing you to adjust your strategy to stand out and attract more bookings by offering unique value or superior amenities.

Financial Considerations

Financial considerations involve budgeting for property purchase, renovation, and ongoing expenses. Calculating potential ROI, cash flow, and tax benefits is crucial for optimizing profitability in short-term rental investments.

3.1 Budgeting for Property Purchase and Renovation

Budgeting for property purchase and renovation involves assessing location, property price, and renovation costs. Set a realistic budget, including furniture and contingency funds, to ensure financial stability and avoid overspending during the investment process.

3.2 Calculating Potential ROI and Cash Flow

Calculating potential ROI and cash flow involves analyzing rental income, occupancy rates, and expenses. Use financial models to estimate profitability, ensuring accurate projections. Consider property management fees, taxes, and maintenance costs to determine sustainable cash flow and long-term investment viability.

3.4 Tax Benefits and Deductions for Rental Properties

Owning a rental property offers tax benefits, including deductions for mortgage interest, property taxes, insurance, and maintenance. Operating expenses like cleaning, utilities, and management fees can also be deducted, reducing taxable income and optimizing financial returns for investors.

Property Preparation and Management

Property preparation involves furnishing and equipping rentals to attract guests. Effective management includes hiring services and creating maintenance plans to ensure smooth operations and positive guest experiences.

4.1 Furnishing and Equipping Your Rental Property

Furnishing and equipping your rental property is crucial for attracting guests. Ensure the space is functional, stylish, and well-stocked with essentials like furniture, appliances, and linens. High-quality amenities and modern decor can enhance guest comfort and satisfaction, making your property stand out in a competitive market.

4.2 Hiring Property Management Services

Hiring professional property management services can streamline operations, especially for absentee owners. These services handle guest communication, cleaning, and maintenance, ensuring consistent quality and timely issue resolution. This hands-off approach allows investors to focus on growth while maximizing rental income and maintaining property value.

4.3 Creating a Maintenance and Repair Plan

A well-structured maintenance plan ensures your property remains in prime condition. Regular inspections, prompt repairs, and budgeting for unexpected expenses are crucial. Implementing a proactive approach prevents major issues, reduces downtime, and maintains guest satisfaction, ultimately safeguarding your investment and long-term profitability in the competitive rental market.

Legal and Regulatory Considerations

Understanding local laws, obtaining necessary licenses, and securing proper insurance are vital for compliance. Regular updates on regulations ensure smooth operations and avoid legal pitfalls, protecting your investment and maintaining profitability.

5.1 Understanding Local Laws and Regulations

Researching local ordinances is crucial for compliance. Many cities enforce specific rules for short-term rentals, including permit requirements and occupancy limits. Staying informed helps avoid penalties and ensures legal operation, safeguarding your investment and maintaining good community relations. Always verify regulations before listing a property.

5.2 Obtaining Necessary Licenses and Permits

Securing proper licenses and permits is essential for legal operation. Requirements vary by location, often including business licenses, zoning approvals, and health certifications. Annual renewals may apply, and failure to comply can result in fines or shutdowns. Research local requirements thoroughly to ensure full compliance.

5.3 Insurance Requirements for Short-Term Rentals

Short-term rentals require specific insurance coverage to protect against risks like property damage and liability. Standard homeowner policies often exclude rental activities, so specialized insurance is necessary. Ensure coverage includes guest injuries, theft, and vandalism. Verify local requirements, as some areas mandate additional coverage for short-term properties.

Marketing Your Short-Term Rental

Effective marketing involves creating compelling listings with high-quality photos and virtual tours. Highlighting amenities and location attracts potential guests. Leverage social media and dynamic pricing to maximize visibility and bookings, ensuring your property stands out in a competitive market.

6.1 Creating an Effective Listing Description

A compelling listing description highlights key features, amenities, and local attractions. Use clear, concise language to convey the property’s unique value, ensuring it appeals to your target audience. Incorporate relevant keywords to improve search visibility and entice potential guests to book your rental property.

6.2 Using High-Quality Photography and Virtual Tours

High-quality photography and virtual tours are essential for showcasing your rental’s best features. Professional images highlight amenities and spaces, while virtual tours provide an immersive experience. These visual tools attract potential guests, increase bookings, and build trust, making your listing stand out in a competitive market.

6.3 Leveraging Social Media for Promotion

Leverage social media platforms like Instagram and Facebook to showcase your rental’s unique features. Share high-quality images, behind-the-scenes content, and guest testimonials. Engage with followers by responding to comments and messages promptly. Paid ads can target specific audiences, increasing visibility and bookings. Consistent posting builds trust and attracts potential guests.

Guest Management and Communication

Effective guest management and communication are crucial for building trust and ensuring positive experiences. Clear expectations, prompt responses, and personalized interactions help create a seamless stay, fostering loyalty and repeat business.

7.1 Setting House Rules and Expectations

Clearly defining house rules and expectations is essential for a smooth guest experience. Establishing guidelines on check-in times, noise levels, and occupancy limits helps protect your property and ensures compliance. Transparent communication of these rules in listings and agreements minimizes misunderstandings and fosters mutual respect between hosts and guests.

7.2 Handling Bookings and Cancellations

Efficiently managing bookings and cancellations is crucial for maintaining a smooth rental operation. Establish clear policies for cancellations, refunds, and amendments. Use booking software to track reservations and communicate promptly with guests. Having backup plans, such as a waiting list, can mitigate losses from last-minute cancellations. Ensure all terms are clearly outlined.

7.3 Building Positive Relationships with Guests

Building positive relationships with guests fosters loyalty and repeat bookings. Ensure clear, respectful communication and prompt responses to inquiries. Provide a welcoming environment with essential amenities and personal touches. Encourage feedback and address concerns swiftly to maintain trust and satisfaction, enhancing your reputation as a host.

Technology and Tools

Technology optimizes short-term rental operations through property management software, dynamic pricing tools, and automated guest communication. These solutions enhance efficiency, streamline tasks, and improve guest experiences, ultimately boosting profitability and scalability for investors.

8.1 Using Property Management Software

Property management software streamlines operations, enabling investors to schedule bookings, track occupancy, and manage pricing dynamically. Automated tools handle guest communication, payments, and maintenance requests, reducing manual effort and enhancing operational efficiency. This technology is essential for scaling and maintaining profitability in a competitive short-term rental market.

8.2 Implementing Dynamic Pricing Strategies

Dynamic pricing strategies adjust rental rates based on real-time demand, seasonality, and market trends. Using tools with machine learning algorithms, investors optimize pricing to maximize revenue during peak periods and minimize vacancies during off-peak times, ensuring competitive rates align with market conditions.

8.3 Automating Guest Communication

Automating guest communication streamlines interactions, saving time and ensuring consistency. Tools like property management software enable pre-set messages for check-ins, check-outs, and feedback requests. Automated systems handle inquiries efficiently, improving guest satisfaction and reducing manual effort, allowing hosts to focus on enhancing the overall rental experience.

Scaling Your Short-Term Rental Portfolio

Scaling your portfolio involves strategic expansion, diversification, and team-building to manage growth effectively. Focus on identifying new markets, acquiring diverse properties, and hiring skilled professionals to optimize operations and maximize returns across your growing rental business.

9.1 Expanding to New Markets

Expanding to new markets involves researching emerging locations with high demand for short-term rentals. Analyze local regulations, seasonal trends, and competition to identify profitable areas. Diversifying your portfolio across different regions can mitigate risks and capitalize on growth opportunities in vibrant cities or tourist hotspots.

9.2 Diversifying Your Rental Properties

Diversifying your rental properties involves investing in varied types, such as apartments, houses, or vacation homes, across different locations. This strategy reduces risk and attracts a broader audience, ensuring steady income. By catering to diverse traveler needs, you can maximize occupancy rates and enhance long-term profitability.

9.3 Building a Team for Portfolio Management

Building a team for portfolio management is crucial for scaling your short-term rental business. Hire property managers, housekeepers, and maintenance staff to handle day-to-day operations. A dedicated team ensures consistent service quality, improves guest satisfaction, and allows you to focus on strategic growth and portfolio expansion.

Risk Management and Problem Solving

Risk management is vital for short-term rental success. Identify potential challenges, such as property damage or guest disputes, and implement strategies like insurance, guest screening, and emergency funds to mitigate risks effectively.

10.1 Mitigating Risks Associated with Short-Term Rentals

Mitigating risks in short-term rentals involves securing proper insurance, implementing guest screening processes, and setting clear house rules. Budgeting for unexpected expenses and maintaining regular property inspections can also help minimize potential losses and ensure a smooth rental experience.

10.2 Handling Difficult Guest Situations

Addressing challenging guest situations requires clear communication and empathy. Establishing house rules, maintaining professional interactions, and documenting incidents can help resolve conflicts. Having a plan for unexpected issues ensures a positive experience for both hosts and guests, fostering long-term relationships and repeat bookings.

10.3 Managing Unexpected Expenses

Unexpected expenses, such as repairs or appliance failures, can impact cash flow. Creating a budget with an emergency fund and prioritizing maintenance helps mitigate these risks. Regular inspections and contingency planning ensure financial stability and minimize disruptions to your rental operations.

Investors should also maintain a network of reliable contractors for quick resolutions, ensuring properties remain operational and attractive to guests, thus safeguarding long-term profitability and tenant satisfaction.

Future Trends in Short-Term Rentals

The future of short-term rentals lies in technology integration, sustainable practices, and evolving consumer preferences. Trends include smart home automation, eco-friendly accommodations, and personalized guest experiences, shaping the industry’s growth and profitability.

11.1 Emerging Markets and Opportunities

Emerging markets for short-term rentals include regions with growing tourism, such as secondary cities and underserved areas. Investors can capitalize on unique accommodations, like eco-lodges or historic homes, to attract niche travelers seeking authentic experiences, driving demand and potential returns in these untapped locations.

11.2 Impact of Technology on the Industry

Technology is transforming short-term rentals through dynamic pricing tools and automation. Platforms leverage AI for personalized recommendations, while virtual tours and smart locks enhance guest experiences. Property management software streamlines operations, improving efficiency and scalability for investors aiming to maximize returns in a competitive market.

11.3 Adapting to Changing Consumer Preferences

Consumers increasingly favor unique, sustainable, and tech-integrated experiences. Investors must adapt by offering eco-friendly amenities, flexible stay durations, and personalized options. Staying attuned to these evolving preferences ensures properties remain competitive and attractive in a dynamic market, driving long-term success and guest satisfaction.

Understanding the market, financial planning, and adaptability are key to success. Stay informed, embrace industry trends, and take action to start or expand your short-term rental portfolio confidently.

12.1 Summarizing Key Takeaways

Short-term rentals offer lucrative opportunities with proper market analysis, financial planning, and property management. Platforms like Airbnb simplify hosting, enabling investors to capitalize on high demand while leveraging tax benefits and scalable income streams for long-term growth and financial stability.

12.2 Setting Goals for Your Short-Term Rental Business

Set clear, achievable goals for your short-term rental business, such as increasing occupancy rates or expanding your property portfolio. Regularly review and adjust these objectives to align with market trends and financial performance, ensuring sustainable growth and profitability in the competitive rental landscape.

12.3 Taking Action to Start or Grow Your Portfolio

Begin by conducting thorough market research to identify profitable locations. Secure financing or allocate savings for property purchases. Utilize property management tools and platforms to streamline operations. Start small, track performance, and gradually expand your portfolio while adapting to market trends and consumer demands.